Meet

Joseph

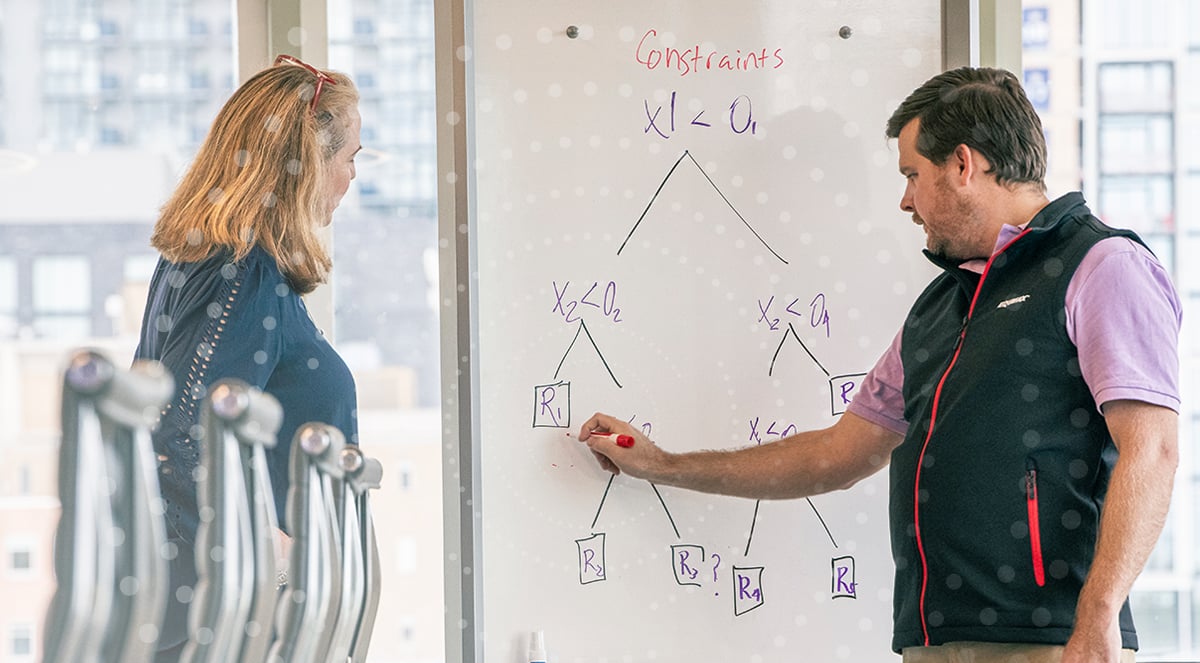

Making sure AI works for people

Joseph White, Distinguished Data Scientist at Equifax, explains how utilizing AI and alternative data helps provide new opportunities for underserved populations.

Artificial intelligence (AI) plays an ever-increasing role in our lives. Equifax is exploring responsible and ethical ways to implement

AI-focused solutions that benefit more people and open greater financial opportunity.

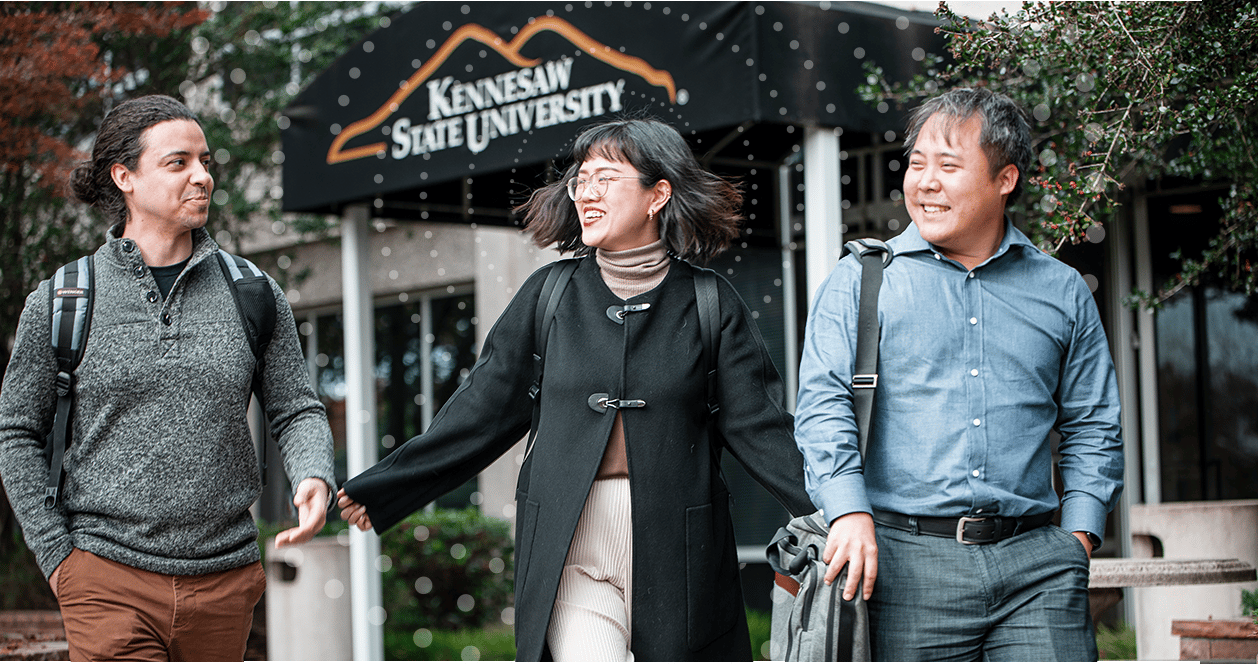

As part of its long-term academic partnership efforts, Equifax has partnered with Georgia’s Kennesaw State University (KSU) to establish an AI Ethics Lab focused on researching the ethical and responsible use of AI in financial services.

“For example, let’s consider a 19-year-old who doesn’t have a job yet and doesn’t have a typical loan. But maybe this person is renting an apartment and paying their cell phone bills.

KSU AI Ethics Lab

Alumni Spotlight

AI is enabling greater financial opportunity for people in the real world.

MinJae Woo was the first Principal Investigator at the KSU AI Ethics Lab. He is passionate about his work that enhances credit models with AI and how it helps consumers.

Equifax has been driving responsible AI innovation for over a decade, with a commitment to ensuring transparency and explainability. Academic partnerships provide additional opportunities for Equifax to harness the power of AI and advanced data science to help people live their financial best.

Learn more about AI at Equifax

Driving Responsible

AI Innovation

A Partnership with KSU

AI helps lenders and financial institutions make even more informed credit decisions. As part of that process, consumers need — and have a right — to know why a decision was made. The collaboration with KSU studies the impacts of this technology and helps to ensure explainability and transparency.

The Lab is designed to study the real-world impacts of integrating AI technology into credit models and to drive innovation that ultimately benefits consumers. The Lab’s four main components of research are Privacy, Robustness, Explainability, and Fairness.

We collaborate with professors and staff researchers to conduct research projects using sample Equifax data. These projects create new insights that help drive the industry forward.

The academic environment supports the development of new data science tools and techniques. By studying example outcomes, these learnings can be leveraged in future product development and innovation at Equifax. Offering the nation’s first doctoral degree in data science and analytics and a newly added bachelor’s degree, KSU is an excellent partner to host the AI Ethics Lab due to its abundance of highly qualified students and professors to help complete the research.

I’m excited about how AI can help enhance our product

offerings, allowing more consumers access to credit they wouldn't otherwise have opportunities to obtain.

Joseph White

Traditionally, we wouldn’t see a credit file for that person—they are what we call ‘credit invisible.’”

In this case, White says that AI could help make the credit invisible visible—allowing Equifax to build insights from greater amounts of data including alternative sources, which helps lenders, service providers, and government agencies make more holistic decisions and open financial opportunities to otherwise underserved individuals, benefiting the full lending ecosystem.

Working on ethics in AI is important because it creates a

driving force for positive change.

Minjae Woo

Woo now holds a Ph.D. in Biomedical Data Science and Informatics and is the Assistant Professor of Data Science at Clemson University. His research explores the fairness and explainability of AI/ML applications, along with strategies that protect against potential harm or disparate impacts against vulnerable populations.

Equifax has led the way toward an industry standard for explainable AI (xAI) and holds 300+ pending and approved patents supporting our approach to AI.

Working with academic partners allows Equifax to tap into new thinking and search for innovative solutions, while growing the talent pool and cultivating the next generation of data scientists.

Through their research and partnership with Equifax, data scientists at academic institutions are not only establishing best practices for new methods of credit modeling— they’re also unlocking financial opportunities for people who have been traditionally excluded from mainstream financial services.

Ultimately, AI can help lift more people into higher credit bands and provide them with additional financial services.

Linglin Zhang is a former KSU AI Ethics Lab research assistant. Her work at the lab gave her real world experience in helping drive innovation that helps consumers with their finances.

We believe that AI can be used in a responsible manner that

benefits both consumers and the financial services industry.

Joseph White

Ultimately, AI can help lift more people into higher credit bands and provide them with additional financial services.

In the future, White envisions the AI Ethics Lab continuing to be a model for the industry.

Lorem ipsum dolor

sit amet,

consectetur

adipiscing elit

Lorem ipsum dolor

sit amet,

consectetur

adipiscing elit

Joseph White

Lorem ipsum dolor sit amet,

consectetur adipiscing elit

Equifax leverages AI techniques in model development when company research indicates that the inclusion of AI will increase the predictive outcome of the model. Equifax AI requirements are aligned to the National Institute of Standards and Technology (NIST) AI Risk Management Framework and AI Systems are used in a transparent, trustworthy, fair, explainable, and secure manner.

In this case, White says that AI could help make the credit invisible visible—allowing Equifax to build insights from greater amounts of data including alternative sources, which helps lenders, service providers, and government agencies make more holistic decisions and open financial opportunities to otherwise underserved individuals, benefiting the full lending ecosystem.

The Value of

Partnerships

In the future, White envisions the AI Ethics Lab continuing to be a model for the industry.

We are just beginning to understand the transformative effect that AI will have on our world. Partnerships between Equifax and academic institutions like KSU will help to positively impact the lives of consumers and help more people secure their financial future.

Zhang, who recently received a PhD in Data and Analytics from KSU, is now an Equifax employee. She builds models and conducts various research projects as a data scientist.

It’s exciting to see the impact of our work in the real world and know that what I do today will really help people in the future.

Linglin Zhang

Through their research and partnership with Equifax, data scientists at academic institutions are not only establishing best practices for new methods of credit modeling— they’re also unlocking financial opportunities for people who have been traditionally excluded from mainstream financial services.

Ultimately, AI can help lift more people into higher credit bands and provide them with additional financial services.

Meet Linglin Zhang, a former KSU AI Ethics Lab research assistant. Her work at the lab gave her real world experience in helping drive innovation that helps consumers with their finances.

Working on ethics in AI is

important because it

creates a driving force for

positive change.

Minjae Woo

Working on ethics in AI is

important because it

creates a driving force for

positive change.

Minjae Woo