Meet

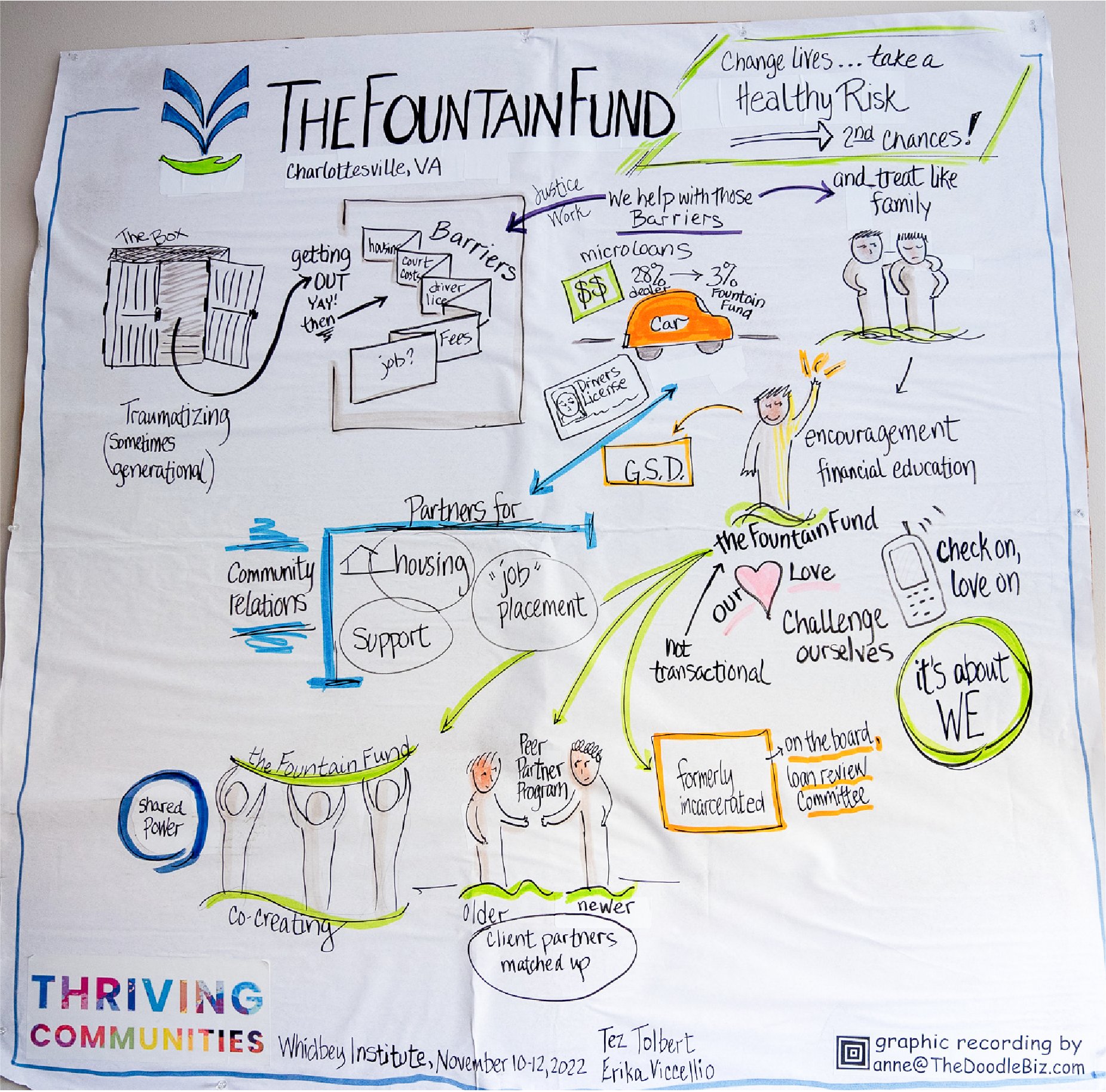

The Fountain Fund as a Source of Empowerment

Paul

One such success story is Troy’s.

After Troy was released from prison,

he was determined to build a better

future—for himself, his family, and

his community. Troy wanted to send

a powerful message to people with a

similar story: that they, too, can

break negative cycles and reclaim

their future.

Paul has worked at The Fountain Fund since

2018 and is steadfast in his devotion to the

organization’s mission. Previously retired, Paul

was energized by the organization’s work, and

he knew that he could push their mission

forward to create real change. As Director of

Economic Empowerment, he is actively working

to help remove hurdles that limit the economic

opportunity of justice-involved people,

preventing them and Charlottesville from

reaching their full potential.

Dreamin’ Queen by James Johnson and Laura Lee Gulledge

A Fountain of

Hope

Within the walls of The Fountain Fund,

dedicated team members work to break

down barriers and support people in their

community in Charlottesville, Virginia.

They work hand-in-hand with justice-involved

people who have been previously incarcerated,

acting not just as advisors but as partners on

this journey toward economic empowerment.

Whether it’s financial coaching, charting

pathways to meet credit goals, approving a

new low-interest loan, or advocating for

greater economic opportunity, The Fountain

Fund is unwavering in their commitment to

improving lives.

But their impact extends beyond their office,

resonating throughout the community as a call

for greater economic inclusion.

As a 501(c)(3) nonprofit lender, The Fountain

Fund is able to provide loans at interest rates

far lower than their Client Partners could

typically receive otherwise—loans that can

provide access to necessities like

transportation, trade certifications, capital to

start businesses, and more. The Fountain Fund is a microlender that reports Client Partners' repayment history to the three nationwide consumer reporting agencies (including Equifax). Positive repayment history is a critical piece in helping establish a positive credit history; one of the many factors in helping to build a higher credit score.

Equifax is a proud partner of Credit Builders Alliance (CBA). The Fountain Fund is one of hundreds of nonprofit lenders, financial educators, and asset builders that are members of CBA’s one-of-a-kind umbrella network, helping millions of low-to-moderate-income individuals across the nation build credit.

Enabling financial opportunity for justice-involved individuals is an important part of driving greater financial inclusion. Partnering with CBA underscores our commitment to financial inclusion and helping people to live their financial best.

The Fountain Fund works as a microlender for

people who have dealt with the criminal justice

system. Their coaching and public policy

advocacy amplify the power of the financial

opportunities they provide.

“It makes a big, big difference in people’s lives.

We give people hope.”

Paul believes in the people he works with at

The Fountain Fund, partly because of the

success stories he’s witnessed.

Formerly incarcerated individuals are an underserved population.

Meet

Troy

When Troy Robinson arrived for his

interview, he was greeted with

warm laughter and a big hug from

Paul Yates. Their connection was

immediately apparent.

As a high school student, Troy was a highly

scouted football player. He had a big and bright future ahead until he was convicted for his

refusal to assist in a drug investigation. Troy was

18 years old when he was sentenced to 54 years

in prison. Despite a reduction in his sentence by

the governor of Virginia and receiving early

parole, everything was different when Troy was

released, and he began reentry into society.

Things had changed. He had

changed. There were unforeseen

obstacles and new challenges

ahead. But he was determined.

“What you did is not who you are.” An

important philosophy that underscores all

Troy has accomplished and everything he

promotes in his community. It’s also the same

message Paul sent Troy when they first

connected through The Fountain Fund.

Through the support and access to financial education and resources offered by organizations like The Fountain Fund, Troy

was able to launch his Order Up! Mobile Food

& Catering business, which is thriving and expanding throughout Charlottesville.

“Giving somebody money without the knowledge of how to use it is almost setting them up for certain failure. I’m learning to utilize credit in a proper way.” Responsible

use of financial tools and building a positive credit history is another asset Paul has

helped Troy understand.

The Fountain Fund illustrates how Equifax works with Credit Builders Alliance to positively impact and transform local communities throughout the U.S.

Over time, Troy has become a pillar in his community through his success with Order Up! and other business ventures, his regular appearances as a host on local talk radio, and his outreach across the city, which includes providing meals for local students in need.

Through the knowledge he’s acquired working with The Fountain Fund, Troy has helped his children gain a stronger financial education: “Let’s understand what this money can do for us in the long term instead of looking at it as a resource to go get what we want.”

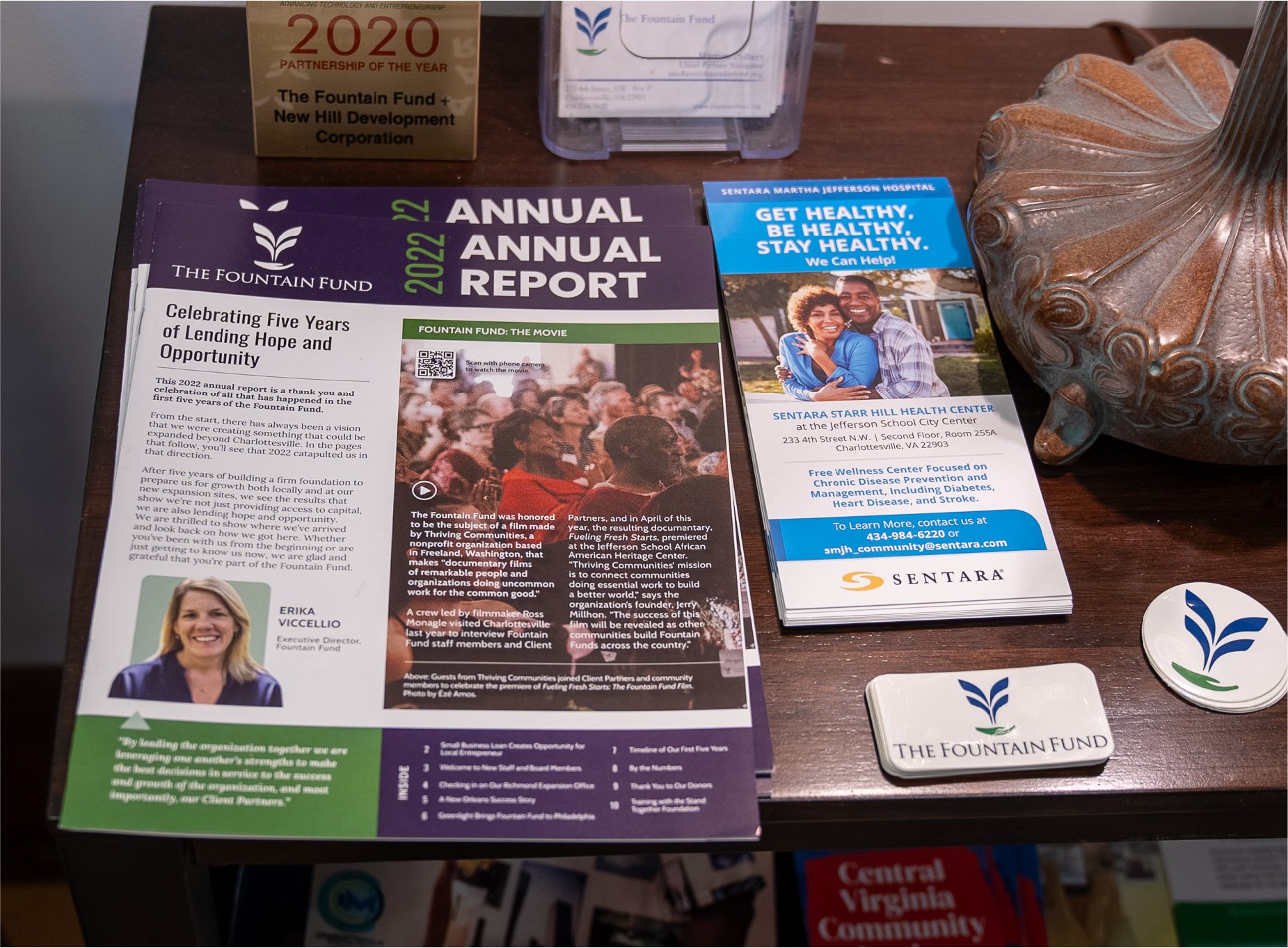

Since its inception in Charlottesville in 2017, The Fountain Fund has extended more than 350 low-interest microloans, helping 86% of client partners establish or improve their credit scores. The organization’s success has enabled them to expand to include offices in Richmond, VA; Philadelphia; and New Orleans, empowering them to positively impact more people’s lives and create more success stories like Troy’s in the future.

Troy’s story speaks to the power of communities working together to uplift one another. With help from Equifax and Credit Builders Alliance, second chances are being unlocked by nonprofits in local communities across the nation. Stories like Troy’s strengthen our dedication to opening the door for greater financial opportunity.

Learn more about our work to support financial inclusion.

Since its inception in Charlottesville in 2017, The Fountain Fund has extended more than 776 low-interest microloans, helping on average 70% of client partners establish or improve their credit scores. The organization’s success has enabled them to expand to include offices in Richmond, VA; Philadelphia; and New Orleans, empowering them to positively impact more people’s lives and create more success stories like Troy’s in the future.

Source: 2024 Annual Report, The Fountain Fund

Since its inception in Charlottesville in

2017, The Fountain Fund has extended

more than 350 low-interest microloans,

helping 86% of client partners establish

or improve their credit scores. The

organization’s success has enabled

them to expand to include offices in

Richmond, VA; Philadelphia; and

New Orleans, empowering them to

positively impact more people’s lives

and create more success stories like

Troy’s in the future.